SANTA CLARA, Calif. (AP) — Building the current crop of artificial intelligence chatbots has relied on specialized computer chips pioneered by Nvidia, which dominates the market and made itself the poster child of the AI boom.

But the same qualities that make those graphics processor chips, or GPUs, so effective at creating powerful AI systems from scratch make them less efficient at putting AI products to work.

That's opened up the AI chip industry to rivals who think they can compete with Nvidia in selling so-called AI inference chips that are more attuned to the day-to-day running of AI tools and designed to reduce some of the huge computing costs of generative AI.

“These companies are seeing opportunity for that kind of specialized hardware,” said Jacob Feldgoise, an analyst at Georgetown University's Center for Security and Emerging Technology. “The broader the adoption of these models, the more compute will be needed for inference and the more demand there will be for inference chips.”

It takes a lot of computing power to make an AI chatbot. It starts with a process called training or pretraining — the “P” in ChatGPT — that involves AI systems “learning” from the patterns of huge troves of data. GPUs are good at doing that work because they can run many calculations at a time on a network of devices in communication with each other.

However, once trained, a generative AI tool still needs chips to do the work — such as when you ask a chatbot to compose a document or generate an image. That's where inferencing comes in. A trained AI model must take in new information and make inferences from what it already knows to produce a response.

GPUs can do that work, too. But it can be a bit like taking a sledgehammer to crack a nut.

“With training, you’re doing a lot heavier, a lot more work. With inferencing, that’s a lighter weight,” said Forrester analyst Alvin Nguyen.

That's led startups like Cerebras, Groq and d-Matrix as well as Nvidia's traditional chipmaking rivals — such as AMD and Intel — to pitch more inference-friendly chips as Nvidia focuses on meeting the huge demand from bigger tech companies for its higher-end hardware.

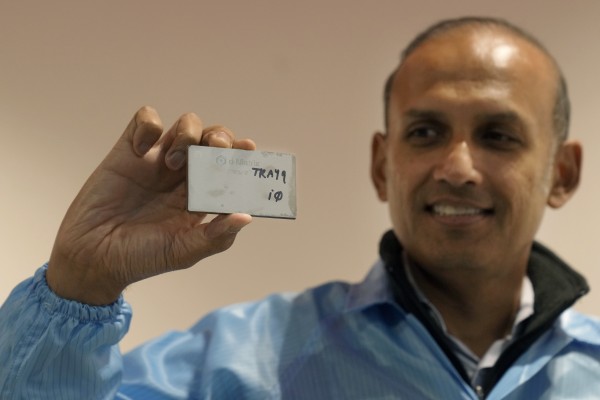

D-Matrix, which is launching its first product this week, was founded in 2019 — a bit late to the AI chip game, as CEO Sid Sheth explained during a recent interview at the company’s headquarters in Santa Clara, California, the same Silicon Valley city that's also home to AMD, Intel and Nvidia.

“There were already 100-plus companies. So when we went out there, the first reaction we got was ‘you’re too late,’” he said. The pandemic's arrival six months later didn't help as the tech industry pivoted to a focus on software to serve remote work.

Now, however, Sheth sees a big market in AI inferencing, comparing that later stage of machine learning to how human beings apply the knowledge they acquired in school.

“We spent the first 20 years of our lives going to school, educating ourselves. That’s training, right?” he said. “And then the next 40 years of your life, you kind of go out there and apply that knowledge — and then you get rewarded for being efficient.”

The product, called Corsair, consists of two chips with four chiplets each, made by Taiwan Semiconductor Manufacturing Company — the same manufacturer of most of Nvidia's chips — and packaged together in a way that helps to keep them cool.

The chips are designed in Santa Clara, assembled in Taiwan and then tested back in California. Testing is a long process and can take six months — if anything is off, it can be sent back to Taiwan.

D-Matrix workers were doing final testing on the chips during a recent visit to a laboratory with blue metal desks covered with cables, motherboards and computers, with a cold server room next door.

While tech giants like Amazon, Google, Meta and Microsoft have been gobbling up the supply of costly GPUs in a race to outdo each other in AI development, makers of AI inference chips are aiming for a broader clientele.

Forrester's Nguyen said that could include Fortune 500 companies that want to make use of new generative AI technology without having to build their own AI infrastructure. Sheth said he expects a strong interest in AI video generation.

“The dream of AI for a lot of these enterprise companies is you can use your own enterprise data,” Nguyen said. “Buying (AI inference chips) should be cheaper than buying the ultimate GPUs from Nvidia and others. But I think there’s going to be a learning curve in terms of integrating it.”

Feldgoise said that, unlike training-focused chips, AI inference work prioritizes how fast a person will get a chatbot's response.

He said another whole set of companies is developing AI hardware for inference that can run not just in big data centers but locally on desktop computers, laptops and phones.

Better-designed chips could bring down the huge costs of running AI to businesses. That could also affect the environmental and energy costs for everyone else.

Sheth says the big concern right now is, “are we going to burn the planet down in our quest for what people call AGI — human-like intelligence?”

It’s still fuzzy when AI might get to the point of artificial general intelligence — predictions range from a few years to decades. But, Sheth notes, only a handful of tech giants are on that quest.

“But then what about the rest?” he said. “They cannot be put on the same path.”

The other set of companies don’t want to use very large AI models — it’s too costly and uses too much energy.

“I don’t know if people truly, really appreciate that inference is actually really going to be a much bigger opportunity than training. I don’t think they appreciate that. It’s still training that is really grabbing all the headlines,” Sheth said.

http://accesswdun.com/article/2024/11/1272891