ATLANTA (AP) — Nearly 3 million people could receive a boost in Social Security payments under legislation set for a final Senate vote in the coming days.

The Social Security Fairness Act would end longtime provisions that reduce the federal benefit for people who are also eligible for other pensions. The policies have heavily affected people who worked in state, local and federal government jobs, as well as teachers, firefighters and police officers, according to lawmakers and advocates.

The bill has bipartisan support but has drawn some criticism from some conservatives. The House approved the measure in November by a vote of 327-75 and the bill easily cleared its first hurdle in the Senate on Wednesday. Its backers hope the Senate will vote to send the legislation to President Joe Biden before lawmakers’ lame-duck session gives way to the new Congress in January.

Here is more on what the bill would mean:

The bill would repeal two provisions that limit Social Security benefits for certain recipients based on retirement payments they get from other sources — most often, but not exclusively, a public retirement program of a state or local government.

The Windfall Elimination Provision modifies the usual benefit formula for retirees or disabled workers who are entitled to pension payments based on earnings from jobs that were not covered by Social Security.

The details vary person to person but the idea, broadly, is that a monthly benefit is reduced by an amount tied to how much that person is receiving from a pension program in which they enrolled in lieu of paying Social Security payroll taxes.

The Government Pension Offset follows a similar principle. It limits Social Security spousal benefits (those paid to a spouse based on their living spouse’s work and payroll tax history) and the widow’s or widower’s benefits (paid after a spouse’s death). Reductions are based on pension benefits for a retired federal, state or local government worker who opted out of some or all Social Security taxes and instead paid into another public retirement insurance program.

Current law establishes the offset at two-thirds of an alternative pension payment.

Under that standard, for example, a retired public health nurse might receive a $1,500 monthly disbursement from a state retirement system that does not participate in Social Security. Then, if that person becomes eligible to receive a spouse's Social Security benefit after the spouse's death, that survivor's Social Security benefit would be reduced by $1,000 each month.

Social Security is commonly understood as a universal system in which everyone participates by paying Social Security payroll taxes and later getting benefits. But federal law has carved out exceptions. Generally, there are a few job categories that can be exempted and, thus, trigger benefit offsets:

— Civilian federal employees hired before 1984 are covered under the Civil Service Retirement System instead of Social Security. Federal workers hired since 1984 are covered under a different federal retirement structure that requires those employees participate in Social Security.

— State and local government employees who participate in their jurisdictions’ retirement systems that allow them to opt out of Social Security.

— Railroad workers who are covered under a separate federal insurance program.

— Some clergy who can opt out.

The Congressional Research Service estimates that in December 2023, there were 745,679 people, about 1% of all Social Security beneficiaries, who had their benefits reduced by the Government Pension Offset. About 2.1 million people, or about 3% of all beneficiaries, were affected by the Windfall Elimination Provision.

The largest category of existing workers whose future benefits could be affected are the state and local government employees.

There are additional people still in the workforce whose future benefits would be affected. CRS estimated that in 2022, about 6.6 million, or 28% of the nation’s state and local government workers, were not covered in the Social Security system. So as those people retire they could become eligible to get money from Social Security that they would not receive without the changes.

The current proposal calls for changes to payments for January 2024 and beyond. If Congress sticks to that timeline, that means the Social Security Administration would owe back-dated payments.

The Congressional Budget Office estimates that eliminating the Windfall Elimination Provision would boost monthly payments to the affected beneficiaries by an average of $360 by December 2025.

The CBO estimates that ending the Government Pension Offset would increase monthly benefits in December 2025 by an average of $700 for 380,000 recipients getting benefits based on living spouses. The increase would be an average of $1,190 for 390,000 or surviving spouses getting a widow or widower benefit.

All those amounts would increase over time with Social Security’s regular cost-of-living adjustments.

For the Social Security program, the expected net spending increase from 2024-34 is about $198 billion. Separately, the changes would yield an estimated $2 billion in savings for the Supplemental Nutritional Assistance Program because those food aid payments would be reduced for some households whose Social Security income increases.

That would mean added fiscal strain on the Social Security Trust funds, which already were estimated to be unable to pay full benefits beginning in 2035. The cost was a reason some House conservatives tried to block the bill. Supporters acknowledged the fiscal impact but said it was a matter of fairness.

It depends.

The proposals moving on Capitol Hill are straightforward: “The Commissioner of Social Security shall adjust primary insurance amounts to the extent necessary to take into account” changes in the law. And the Social Security Administration, through income tax filings, has everyone’s earnings history used to calculate monthly benefit payments under the laws and formulas that Congress sets.

But it's not immediately clear how easily the Social Security Administration could adjust payments for a few million people — whether it could be managed mostly by automated systems recalculating or whether it would require federal employees individually reviewing individual cases with beneficiaries.

Additionally, the proposed changes to the spousal benefits could create newly eligible beneficiaries who are not currently getting such payments and could have to apply specifically for the benefit. The CBO estimates about 70,000 new beneficiaries by the end of 2033.

Also, recipients with complicated formulas – including those that change as Congress tinkers with the law – can sometimes see errors in their payments when they have been automatically recalculated. Backdated payments can be especially problematic.

The Social Security Administration has extensive Q&As and recipient services on its website: ssa.gov. For example, one can calculate how their additional pensions can affect their benefits under current law using this tool. But the agency has not yet addressed the pending legislation publicly.

The agency also operates a toll-free hotline — 1-800-772-1213 — and will schedule in-person meetings at one of hundreds of Social Security offices around the country.

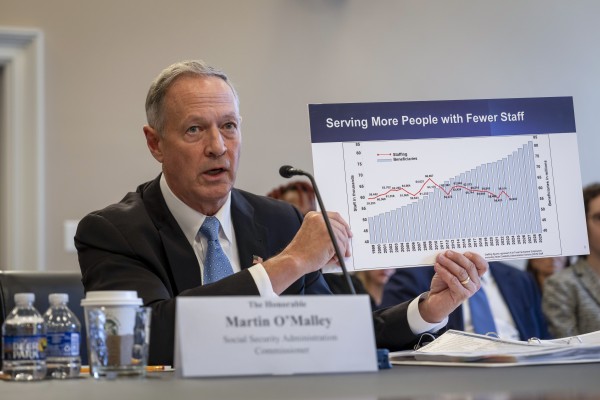

The Social Security Administration has a diminished staff after Congress has for years declined to fund the agency at its requested levels, even as the baby boomer generation ages and adds to the workload. Complex changes from Congress could create or exacerbate backlogs for recipients trying to get the precise benefits required under the law.

http://accesswdun.com/article/2024/12/1277566