Gas prices are likely to fall even lower this week, due to the falling price of oil. Crude prices declined $3.60 last week, which could lead to a decline of about 9 cents at the pump.

"A global glut in oil keeps pushing oil prices lower, which makes it cheaper to produce gasoline," said Mark Jenkins, spokesman, AAA - The Auto Club Group. "Unfortunately, gas prices could eventually rise about 50 cents between February and May as gas supplies tighten due to seasonal refinery maintenance."

Pump prices remain at their lowest level since 2009, providing drivers with noticeable savings in the cost to refuel their vehicles. Sunday's average price of $1.97 per gallon represents a 2 cent discount on the week, and retail averages are down by 18 cents per gallon in comparison to this same date last year. Motorists are likely to continue to save at the pump due to an abundance of crude oil, and barring any unforeseen disruptions in supply averages should remain below $3 per gallon throughout 2016.

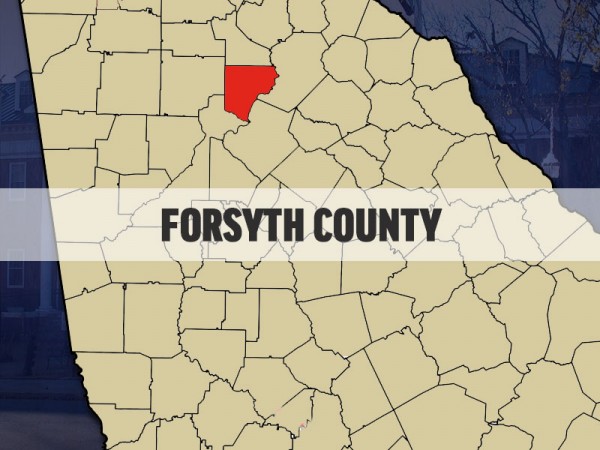

The average price in Florida is $1.98 - 2 cents lower than last week, and 26 cents lower than this time last year. The average price in Georgia is $1.87 - 3 cents lower than last week, and 15 cents lower than this time last year. The average price in Tennessee is $1.73 - 2 cents lower than last week, and 25 cents lower than this time last year.

Gas prices in Florida have declined 52 of the past 60 days. The average prices in Georgia and Tennessee have declined 57 of the last 60 days. Motorists can find gas prices below $2 a gallon at 70 percent of gas stations in Florida, 94 percent of gas stations in Georgia, and 99 percent of gas stations in Tennessee.

Both crude oil benchmarks, Brent and West Texas Intermediate, fell to their lowest prices in approximately 12 years last week due to a number of factors believed to impact crude oil supply and demand. Contrary to historical trends, where tensions in the Middle East lead to reductions in supply, the severing of diplomatic ties between Iran and other nations is expected to lead to an increase in global supply.

The U.S. December jobs report shows a decrease in the number of people employed by the oil and gas extraction sector and domestic companies continue to reevaluate spending and priorities in light of the lower crude oil price environment. A bearish sentiment is expected to prevail in the domestic oil market in the near term and WTI closed out the week down 11 cents, settling at $33.16 per barrel.